In a significant disruption to financial markets and economic planning, the release of the January jobs report—originally scheduled for early February 2026—has been officially delayed. This postponement is a direct consequence of the ongoing federal government shutdown, which has halted operations at the Bureau of Labor Statistics (BLS).

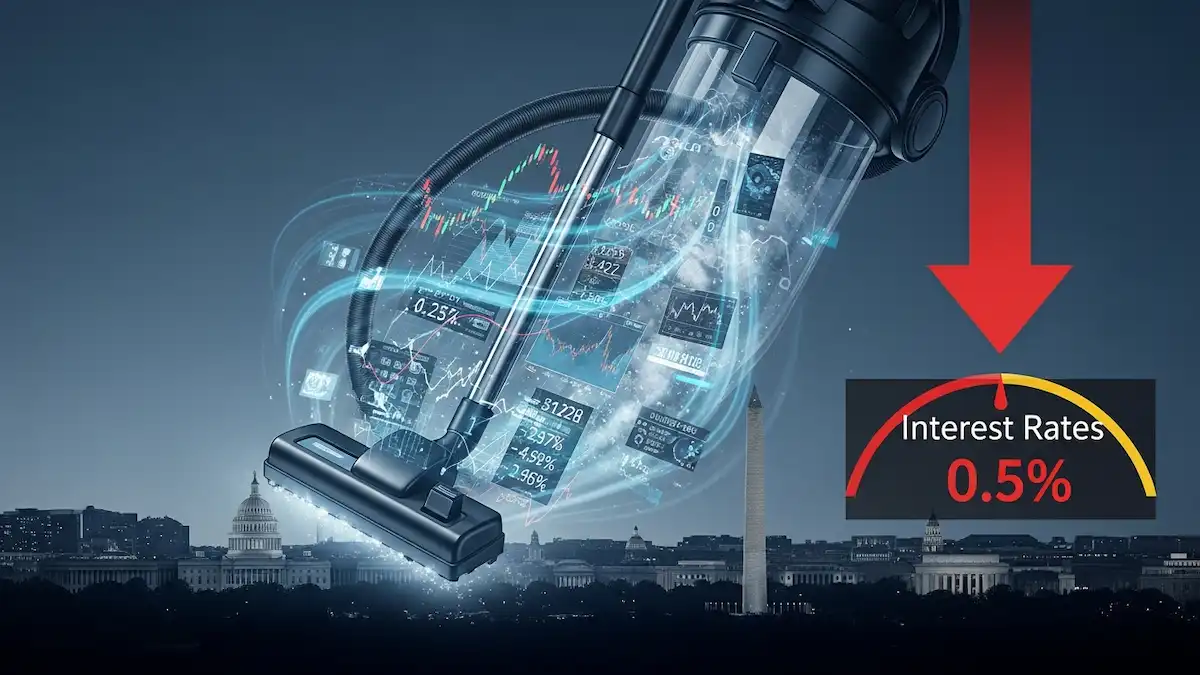

For economists, policymakers, and everyday investors, the jobs report is arguably the most critical economic indicator. Its absence creates a “data vacuum,” making it difficult to gauge the health of the U.S. labor market at a pivotal moment for the economy.

Why the Jobs Report Matters Right Now

The January report is particularly important because it provides the first full look at the economy’s performance in the new year. It includes data on total nonfarm payrolls, the unemployment rate, and wage growth.

In early 2026, the Federal Reserve has been closely monitoring labor data to decide whether to adjust interest rates. Without this information, the central bank is effectively “flying blind,” which increases the risk of policy errors that could impact mortgage rates, business loans, and consumer spending.

The Consequences of a “Data Vacuum”

When the government shuts down, the analysts responsible for collecting and verifying employment data are furloughed. This creates several immediate problems:

-

Market Volatility: Investors dislike uncertainty. Without official data, markets often react to unofficial rumors or private sector reports, which can lead to erratic price swings in stocks and bonds.

-

Delayed Policy Decisions: The Federal Reserve’s “data-dependent” approach is stalled. If the economy is cooling too fast—or heating up—the Fed cannot react appropriately without verified numbers.

-

Business Planning Hurdles: Large corporations rely on wage growth data to set their internal hiring budgets for the year. A delay forces them to wait or make decisions based on outdated information.

How Long Will the Delay Last?

The delay will continue until a funding agreement is reached and federal employees return to work. However, the wait won’t end the moment the government reopens.

Once the BLS resumes operations, there is typically a lag of several days to a week. Staff must process the raw survey data collected from households and businesses before a formal report can be published. This means that even if the shutdown ends today, the January figures may not be available for some time.

Navigating Economic Uncertainty

During a shutdown, experts suggest looking at “proxy” data to understand what is happening in the labor market. While not as comprehensive as the official BLS report, these sources remain active:

-

ADP National Employment Report: A private sector look at payroll changes.

-

Weekly Unemployment Insurance Claims: These are often still processed at the state level, providing a glimpse into layoffs.

-

Consumer Confidence Surveys: These reflect how secure workers feel in their current roles.

-

Data Halt: The January jobs report is on hold due to the federal funding lapse.

-

Fed Impact: The Federal Reserve lacks the necessary data to make informed decisions on interest rate hikes or cuts.

-

Market Risk: Expect increased volatility in the stock market as investors grapple with a lack of official economic guidance.

-

Processing Time: Even after the government reopens, expect a lag before the data is finalized and released.